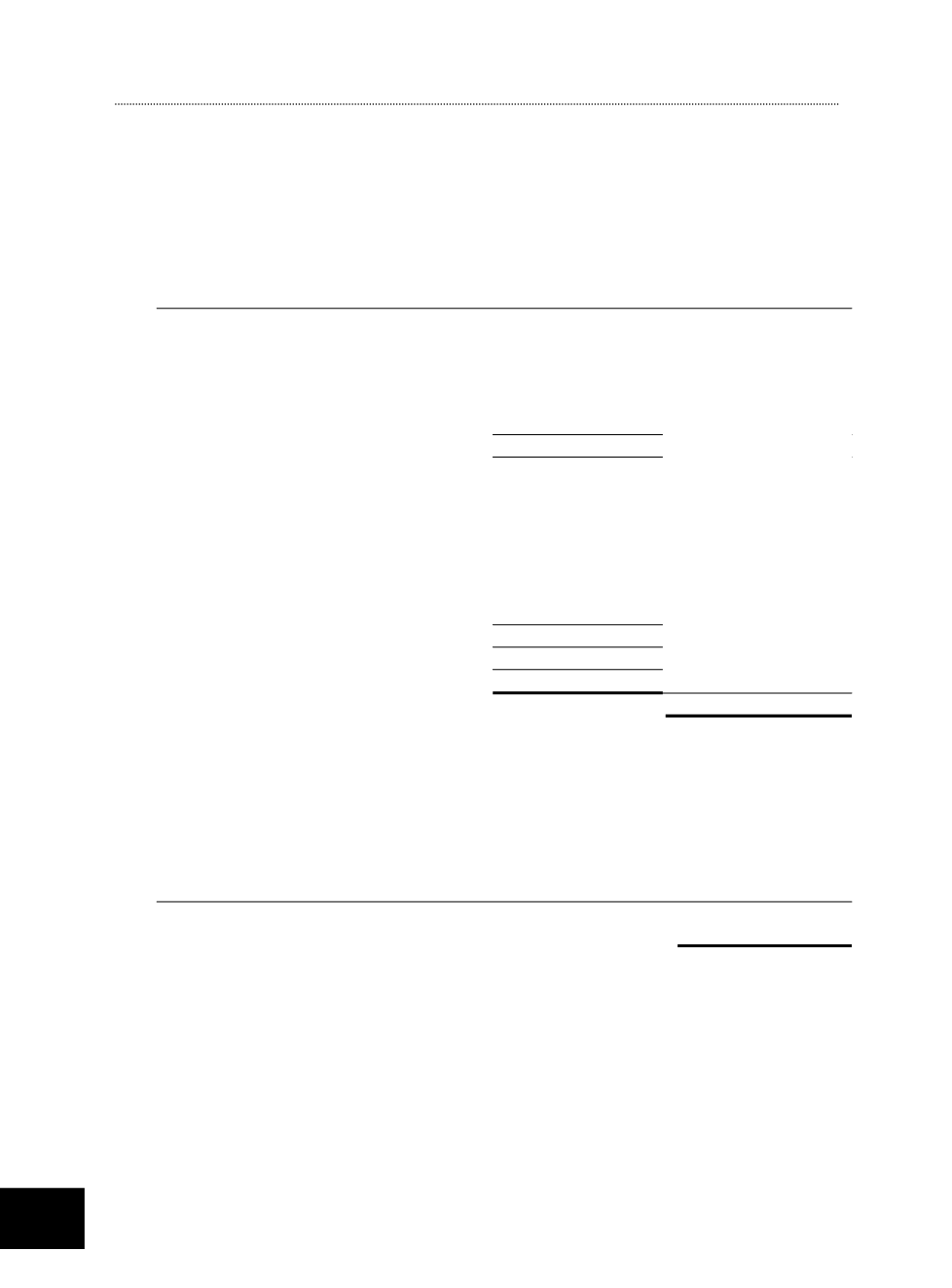

20. Deferred tax liabilities

Group

Statement of

Consolidated

financial position income statement

2015 2014 2015 2014

$’000 $’000 $’000 $’000

Deferred tax assets

Unutilised tax losses and wear and

tear allowances

(2,278)

(1,904)

(1,382)

(1,034)

Allowance for doubtful receivables

(1,055)

(1,345)

290

(237)

Others

(83)

(70)

(11)

(34)

(3,416)

(3,319)

Deferred tax liabilities

Difference in depreciation for

tax purposes

17,912 16,826

1,019

5,324

Fair value adjustments on

business combinations

2,487 3,063

(212)

(204)

Fair value gain on forward

currency contracts

92

–

–

–

20,491 19,889

Net deferred tax liabilities

17,075 16,570

(296)

3,815

Deferred tax assets and liabilities are offset when there is a legally enforceable right to

set off current tax assets against current income tax liabilities and when the deferred

taxes relate to the same taxable entity and the same taxation authority. The deferred tax

amounts determined after appropriate offsetting are as follows:

Group

2015 2014

$’000 $’000

Deferred tax liabilities, net

17,075 16,570

At the end of the reporting period, the Group has undistributed earnings of subsidiaries for

which deferred tax liabilities have not been recognised. No liability has been recognised

in respect of these differences because the Group is in a position to control the timing of

the reversal of the temporary differences and it is probable that the temporary differences

will not reverse in the foreseeable future.

Such temporary differences for which no deferred tax liability has been recognised

aggregate to $56,714,000 (2014: $50,729,000). The deferred tax liabilities are estimated

to be $14,150,000 (2014: $12,702,000).

NOTES TO THE FINANCIAL

STATEMENTS

For the financial year ended 30 June 2015

ASL Marine Holdings Ltd. /Annual Report 2015

136