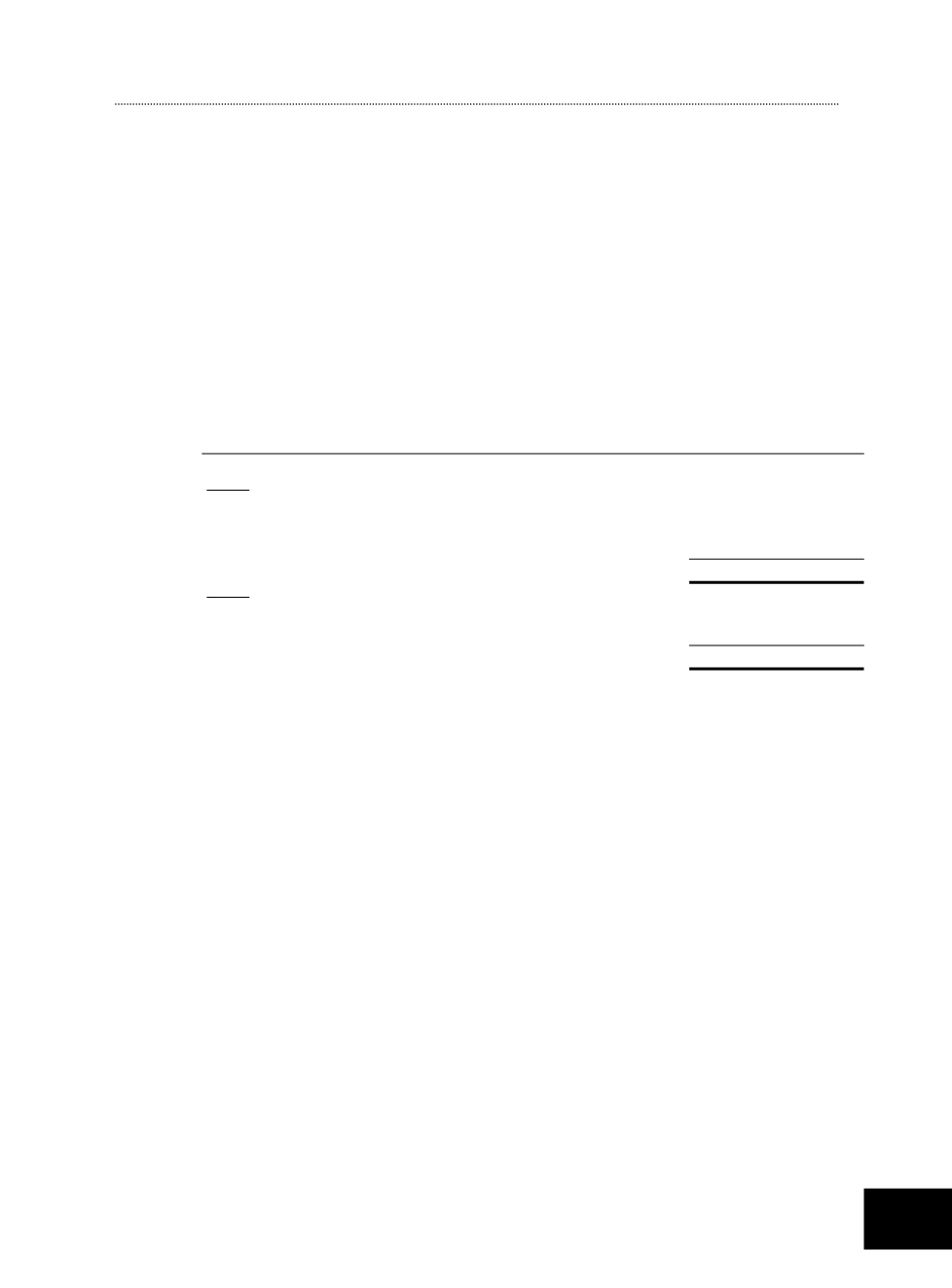

12. Derivative financial instruments (cont’d)

(i)

Forward currency contracts

The Group entered into various foreign exchange forward contracts to sell and purchase

foreign currencies on its future anticipated income and expenditure respectively. As

at 30 June 2015, the terms of these contracts and the fair value adjustments on these

derivative financial instruments are as follows:

Current

notional

Fair value

Forward currency contracts Maturity dates amount

adjustments

Assets Liabilities

Group

$’000 $’000 $’000

2015

Sell

- fixed forward contracts

4 January 2016

– 5 May 2016 48,897 542

–

542

–

2014

Buy

- fixed forward contracts

2 July 2014

41

–

*

–

*

* Denotes amount less than $1,000.

The terms of the forward currency contracts have been negotiated to match the terms

of the commitments.

For cash flow hedges of the expected future sales which were assessed to be

highly effective, a net fair value gain of $542,000 (2014: $Nil) was included in the

hedging reserve.

For cash flow hedges of the expected future purchases which were assessed to

be effective, a net fair value loss of $Nil (2014: loss of $400) was included in the

hedging reserve.

NOTES TO THE FINANCIAL

STATEMENTS

For the financial year ended 30 June 2015

ASL Marine Holdings Ltd. /Annual Report 2015

127