12. Derivative financial instruments (cont’d)

(ii) Interest rate swaps

The Group entered into interest rate swap agreements to hedge its interest rate risk on interest-bearing loans and borrowings

(Note 17). As at 30 June 2015, the terms of these contracts and the fair value adjustments on these interest rate swaps are

as follows:

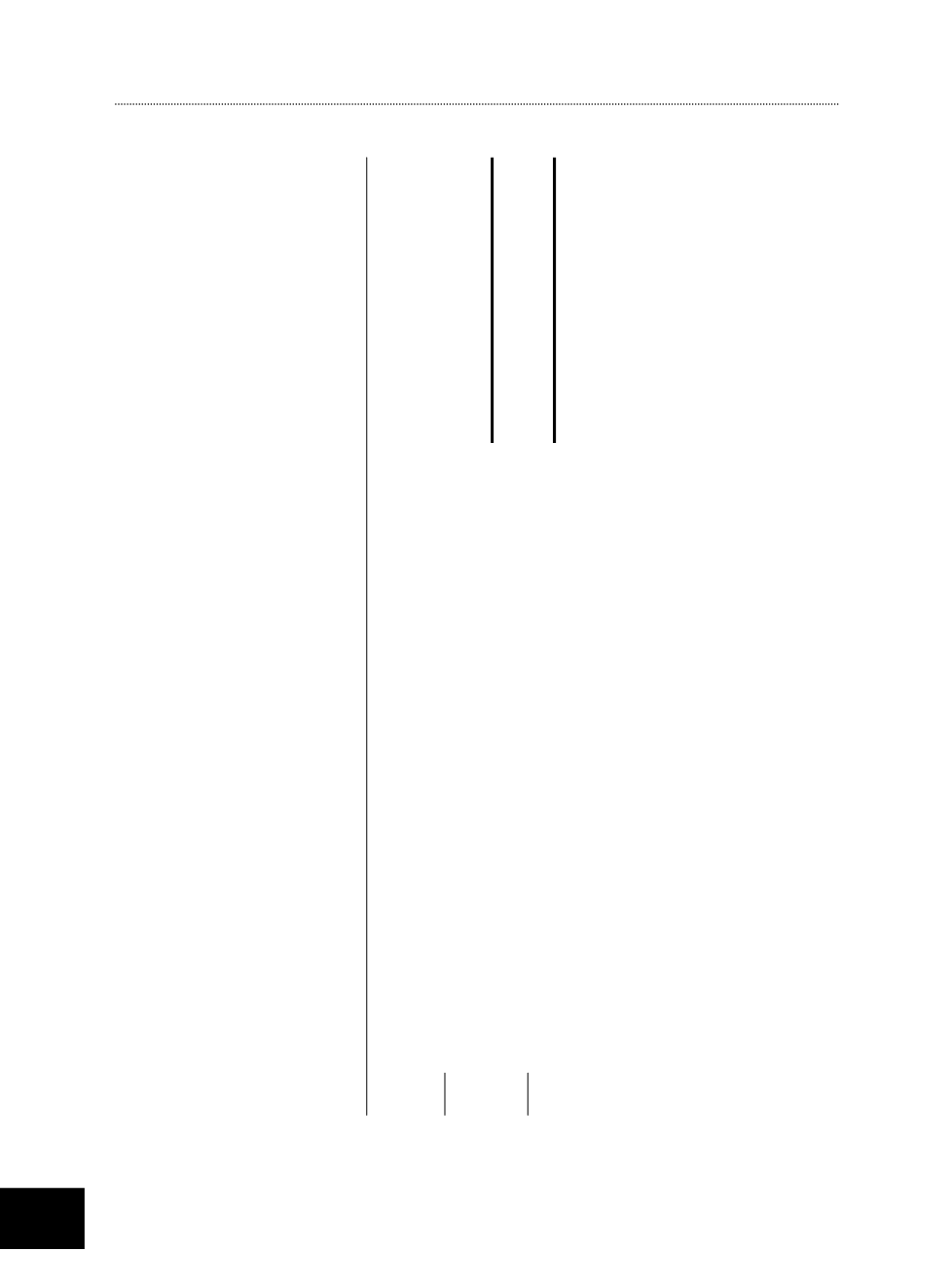

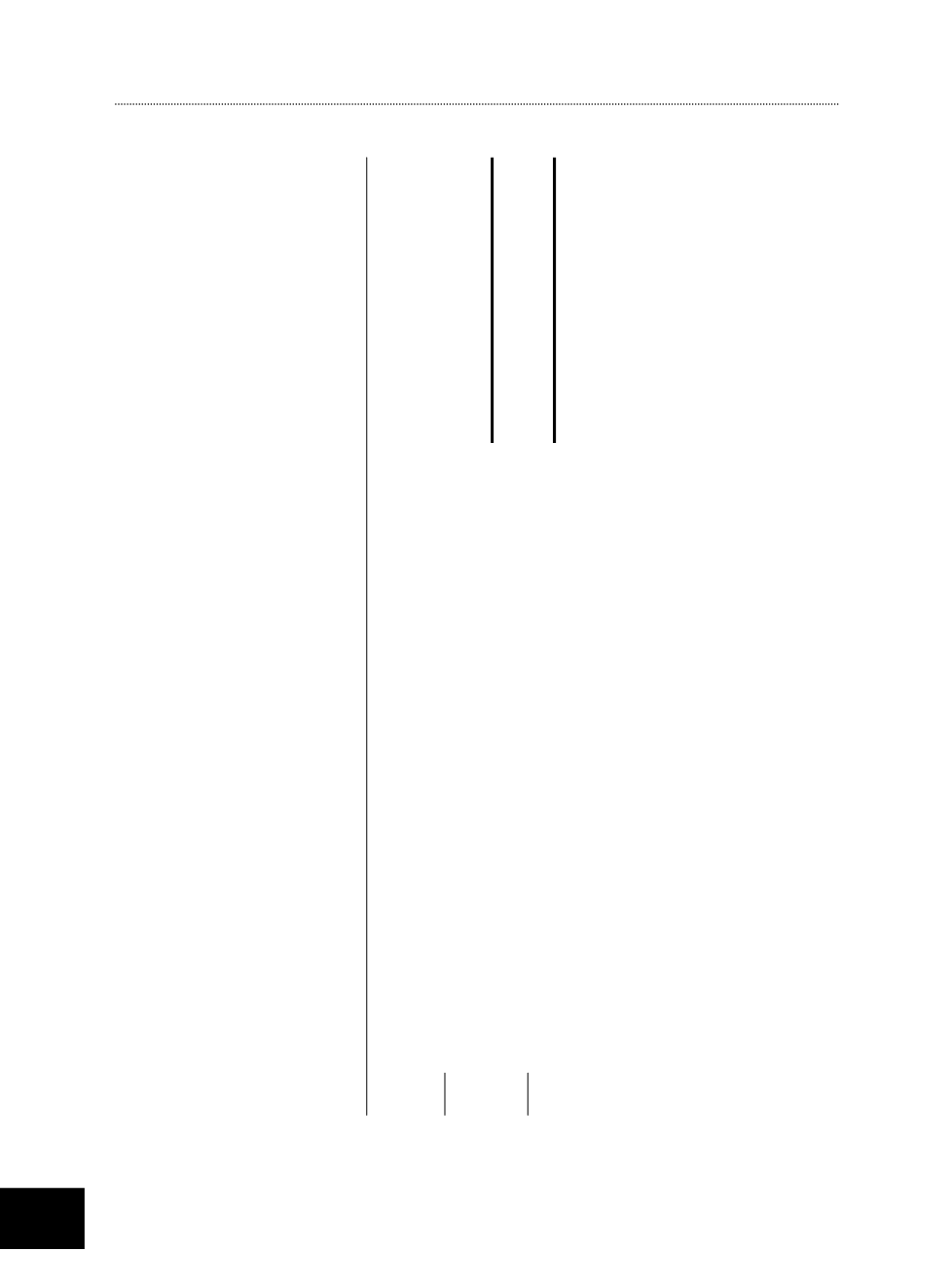

Current

Interest rate swap

notional

Fair value adjustments

agreements

Maturity dates Floating rate Fixed rate amount

Assets Liabilities

%

% $’000

$’000

$’000

Group

2015

United States Dollar loans

1 March 2018

– 1 November 2019 0.17 – 0.19 1.27-1.42 112,620

–

(873)

2014

United States Dollar loans

23 September 2014 0.15 – 0.19

1.97

625

–

(2)

The interest rate swaps entered have the same principal terms as the interest-bearing loans and borrowings. For cash flow

hedges which were assessed to be effective, fair value losses of $873,000 (2014: losses of $2,000) were included in the

Group’s hedging reserves.

NOTES TO THE FINANCIAL

STATEMENTS

For the financial year ended 30 June 2015

ASL Marine Holdings Ltd. /Annual Report 2015

128