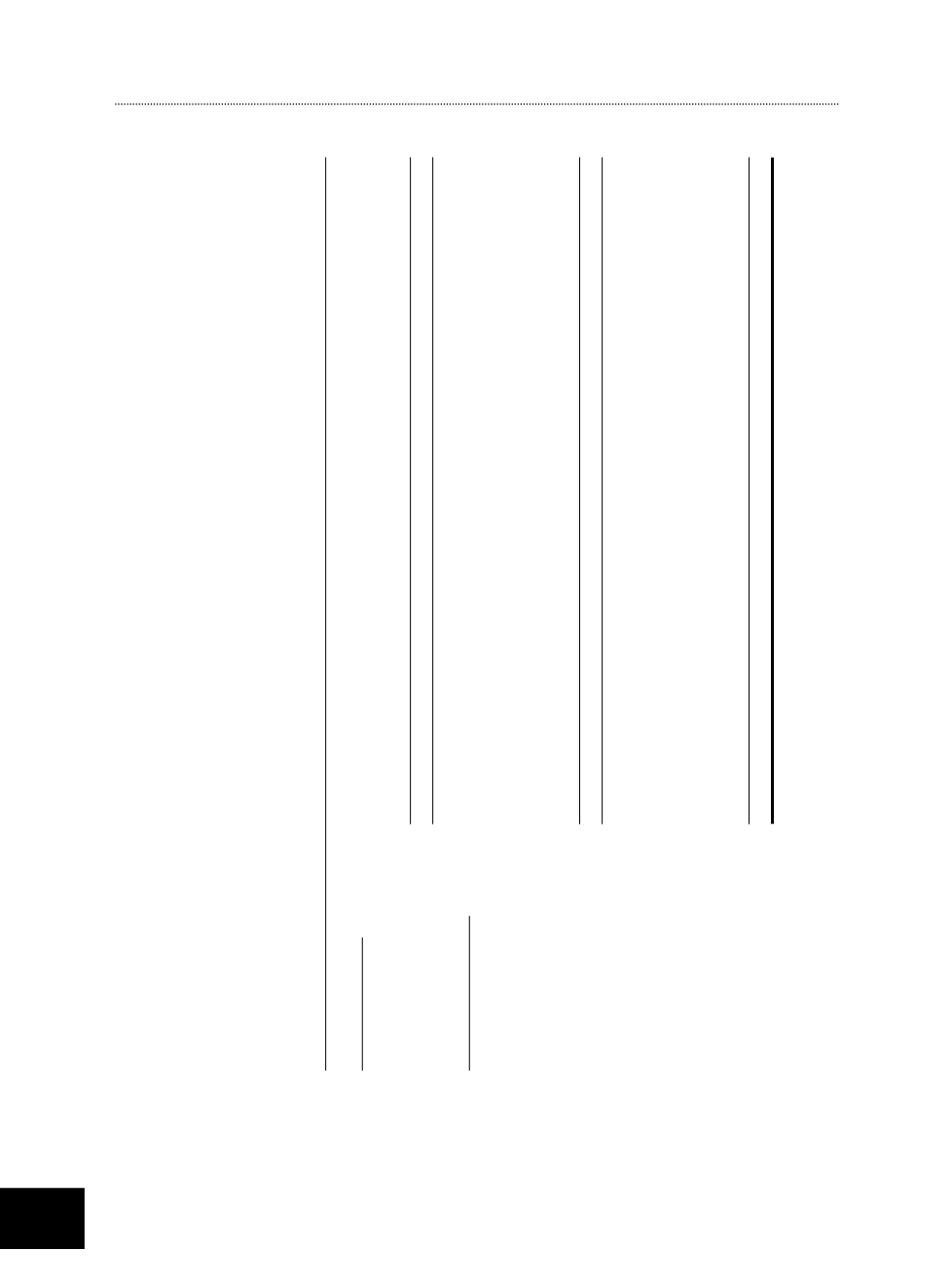

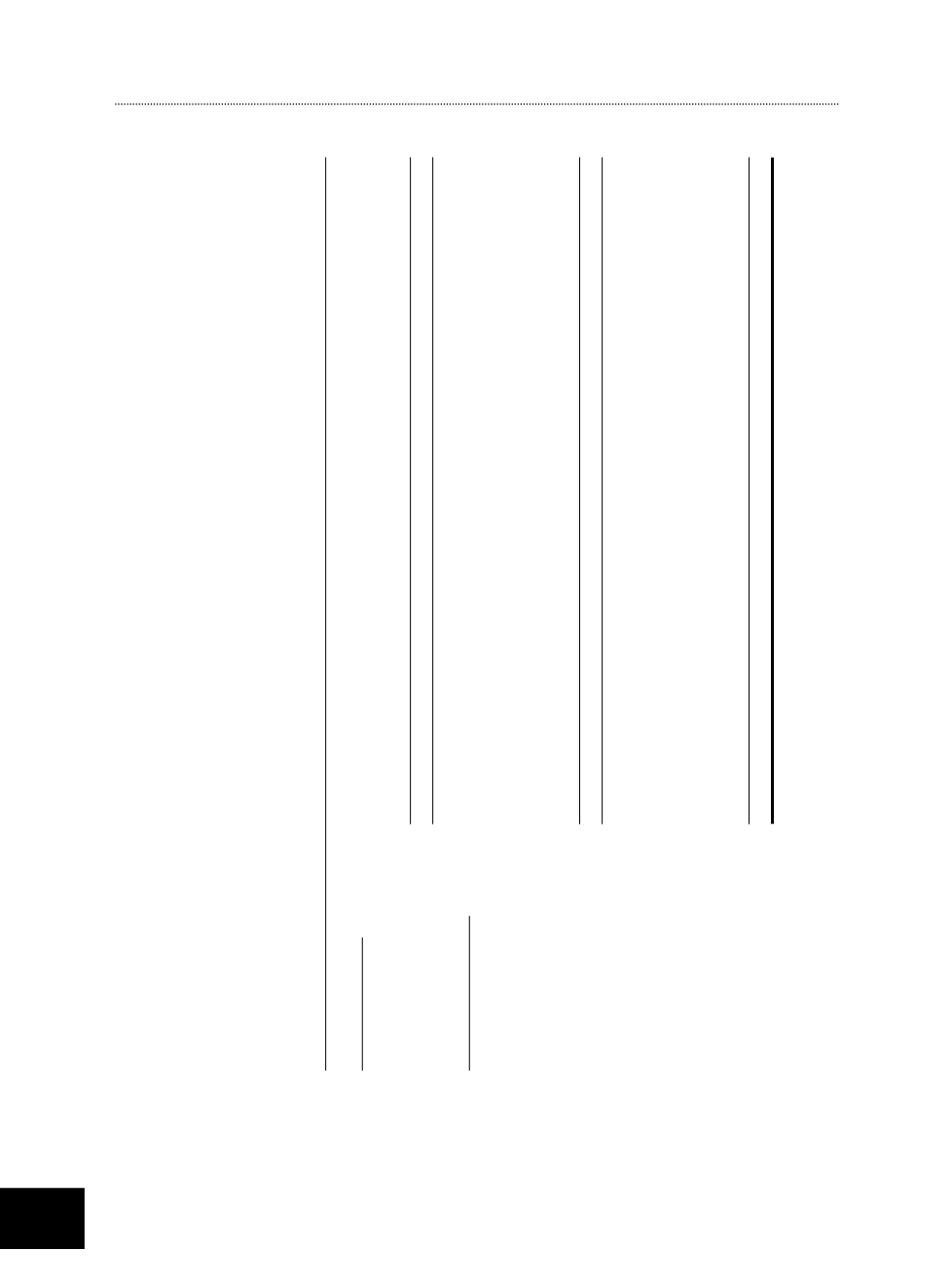

33. Financial risk management objectives and policies (cont’d)

(a) Market risk (cont’d)

(ii) Foreign currency risk (cont’d)

The Group’s exposure to foreign currency is as follows:

Group

SGD USD EUR

IDR RMB Others Total

2015

$’000 $’000 $’000

$’000 $’000 $’000 $’000

Financial assets

Trade and other receivables

121,566 87,620

6,037

5,981

4,550

30 225,784

Cash and bank balances

30,390 22,580 22,811

629

1,433

76 77,919

151,956 110,200 28,848

6,610

5,983

106 303,703

Financial liabilities

Trade and other payables

110,714 29,743 15,655

8,748

4,570

490 169,920

Interest-bearing loans

and borrowings

268,950 203,666

–

–

890

– 473,506

Trust receipts

40,596 19,654

2,179

–

6,418

– 68,847

Bank overdraft

–

–

1,130

–

–

–

1,130

420,260 253,063 18,964

8,748 11,878

490 713,403

Net financial (liabilities)/

assets

(268,304) (142,863)

9,884

(2,138)

(5,895)

(384) (409,700)

Net financial liabilities/

(assets) denominated in

the respective entities’

functional currencies

268,304 33,999

2,297

114

5,431

– 310,145

Currency exposure

– (108,864)

12,181

(2,024)

(464)

(384)

(99,555)

NOTES TO THE FINANCIAL

STATEMENTS

For the financial year ended 30 June 2015

ASL Marine Holdings Ltd. /Annual Report 2015

150