33. Financial risk management objectives and policies (cont’d)

(a) Market risk (cont’d)

(i)

Interest rate risk (cont’d)

Sensitivity analysis

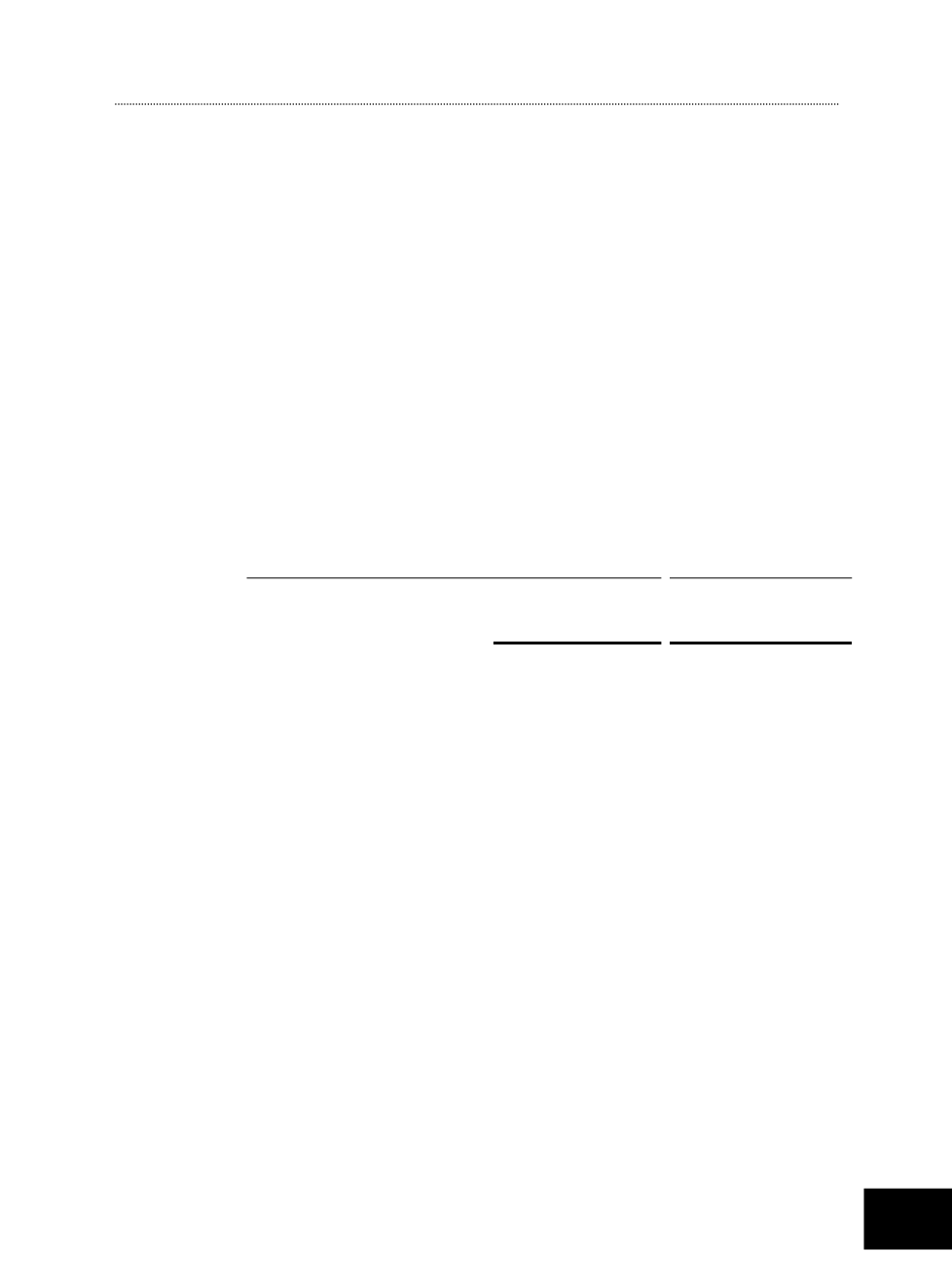

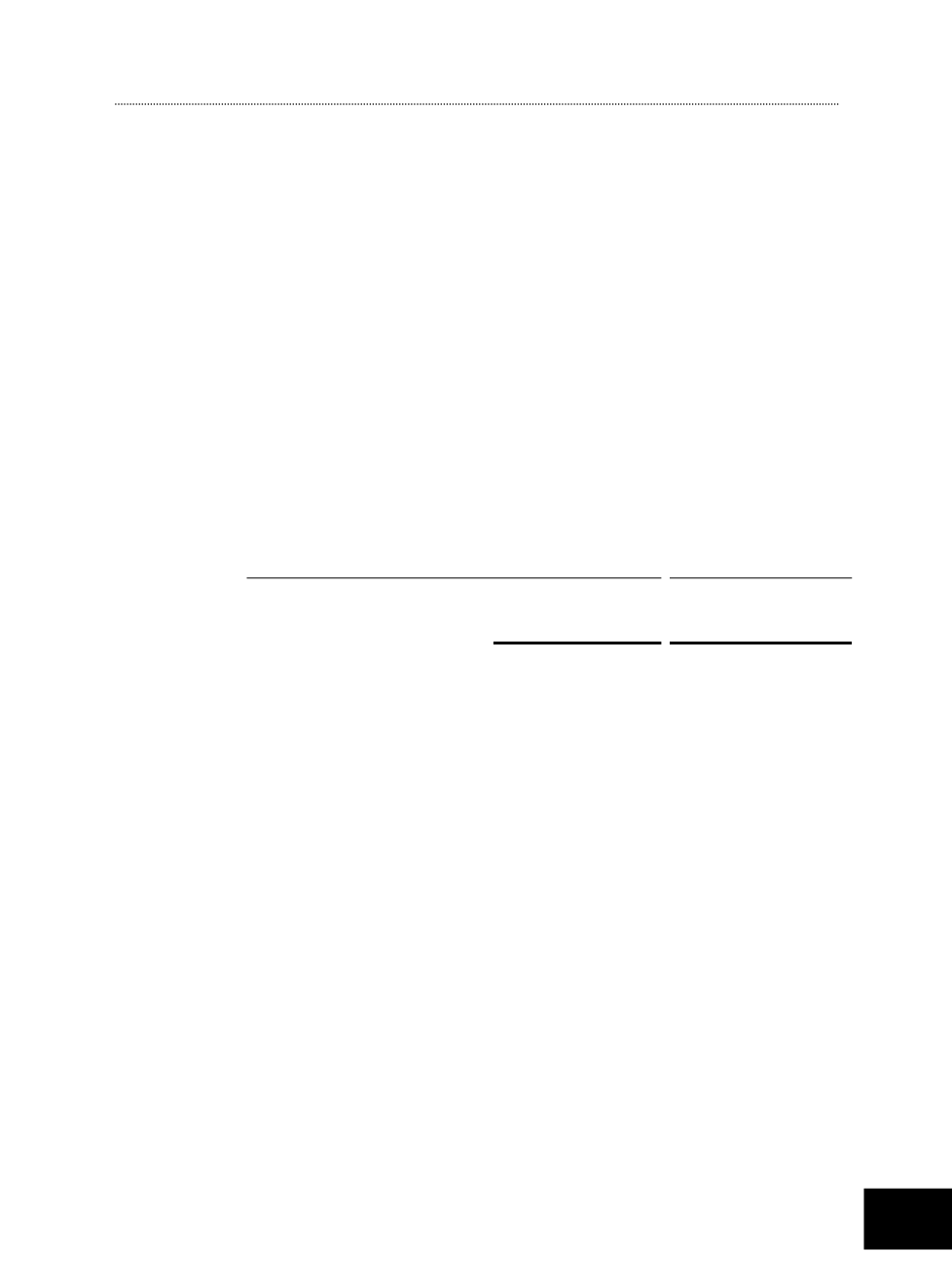

For the Group’s and Company’s borrowings at variable rates on which effective

hedges have not been entered into, an increase of 0.5% (2014: 0.5%) in interest

rate at 30 June would have decreased profit before tax by the amounts shown

below. A decrease of 0.5% (2014: 0.5%) in interest rate at 30 June would have

an equal but opposite effect. The analysis assumes that all other variables, in

particular foreign currency exchange rates, remain constant.

Group

Company

2015 2014 2015 2014

Profit

Profit

Profit

Profit

before tax before tax before tax before tax

$’000 $’000 $’000 $’000

Floating rate

instruments

1,300 2,097

–

–

(ii) Foreign currency risk

The Group has transactional currency exposures arising from sales or

purchases that are denominated in a currency other than the respective

functional currencies of Group entities, primarily United States Dollar (“USD”),

Euro (“EUR”), Indonesia Rupiah (“IDR”), and Chinese Renminbi (“RMB”).

The Group’s trade receivable and trade payable balances at the end of the

reporting period have similar exposures.

The Group and the Company also hold cash and bank balances denominated

in foreign currencies for working capital purposes. At the end of the reporting

period, such foreign currency balances are mainly in USD, EUR and IDR.

Such risks are hedged either by forward foreign exchange contracts in respect

of actual or forecasted currency exposures which are reasonably certain

or hedged naturally by a matching sale or purchase of a matching asset or

liability of the same currency and amount.

The Group is also exposed to currency translation risk arising from its net

investments in foreign operations, including People’s Republic of China (PRC),

Indonesia and Netherlands.

NOTES TO THE FINANCIAL

STATEMENTS

For the financial year ended 30 June 2015

ASL Marine Holdings Ltd. /Annual Report 2015

149