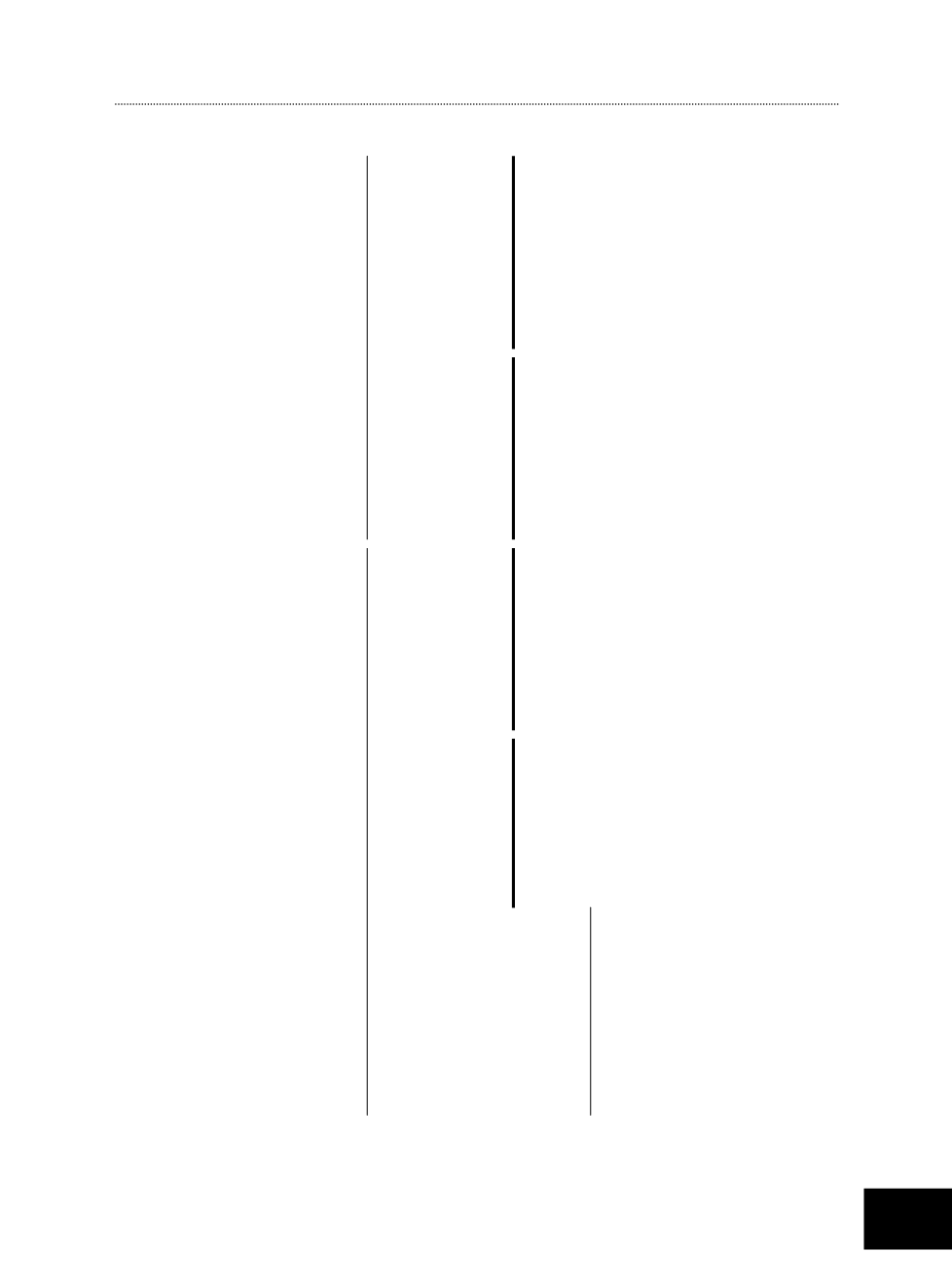

35. Fair value of assets and liabilities (cont’d)

(d) Fair value of financial instruments by classes that are not carried at fair value and whose carrying amounts are not

a reasonable approximation of fair value

The fair value of financial assets and liabilities by classes that are not carried at fair value and whose carrying amounts are

not reasonable approximation of fair value are as follows:

Group

Company

Carrying amount

Fair value

Carrying amount

Fair value

2015

2014 2015 2014

2015 2014

2015

2014

$’000 $’000 $’000 $’000 $’000 $’000

$’000 $’000

Financial liabilities

Finance lease liabilities

(Non-current)(Note 17) 12,940 17,215 11,689 15,596

–

–

–

–

Fixed rate loans

(Non-current)(Note 17) 230,982 100,000 204,121 98,263 150,000 100,000 131,838 98,263

These financial assets and financial liabilities are categorised within Level 3 of the fair value hierarchy.

Determination of fair value

The fair value of finance lease liabilities and interest-bearing loans and borrowings with fixed interest rates are estimated by

discounting expected future cash flows at market incremental lending rate for similar types of lending, borrowing or leasing

arrangements at the end of the reporting period.

NOTES TO THE FINANCIAL

STATEMENTS

For the financial year ended 30 June 2015

ASL Marine Holdings Ltd. /Annual Report 2015

161